connectIPS

ConnectIPS is service offered by Nepal Clearing House which allows us to transfer money directly from our bank account to own bank account or to someone else bank account. Transfer offer by IPS are bank to wallet (khalti & IME pay), wallet to wallet, credit card payment, government payment, Dmat Fee Payment, Share Fee Payment & Stock Broker Payment. The interesting things are the fee is too low than existing any other transfer service like esewa, khalti, ipay, IME pay, western union, City express, Himal remit, GME Remit, Prabhu Remit, Samsara Remit, IME Remit, Siddhart Remit or any other provider in our country.

| Transaction Fee (NRs.) | ||||

| Amount | Up to 500 | 500 to 5,000 | 5,000 to 50,000 | Above 50,000 |

| Fund Transfers | 2 | 5 | 10 | 15 |

| Government Payments | 2 | 5 | 10 | 15 |

| Credit Card Payments | 2 | 5 | 10 | 15 |

| Stock Broker Payments | 2 | 5 | 10 | 15 |

| Wallet Top Up (khalti, IMEpay) | No Charge | No Charge | No Charge | No Charge |

How to activate the connectIPS service?

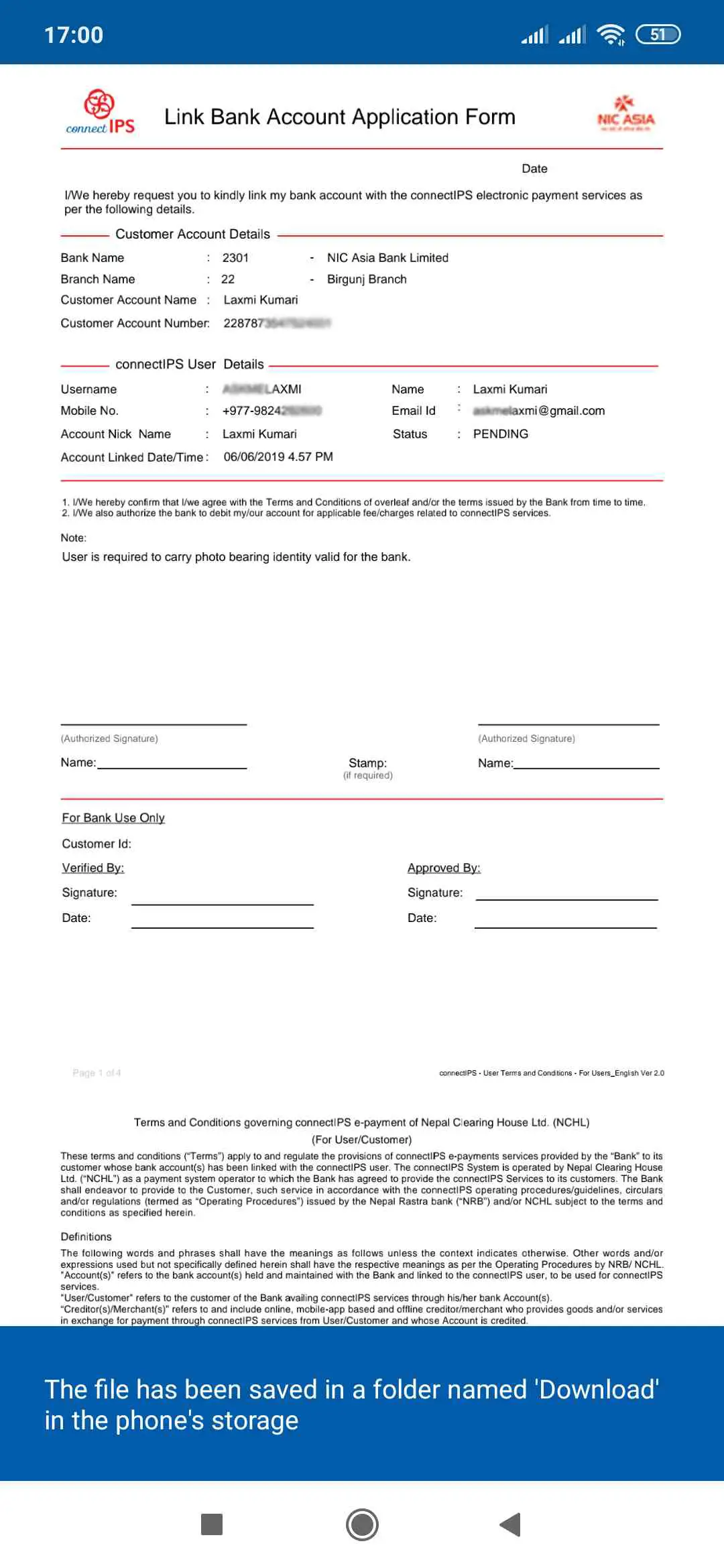

First you can visit https://connectips.com or download apps from play store or download apps from itunes then create an account on web or apps with correct credentials. Login to the apps or web then you have to link your bank account with connectIPS. After linking successfully, you have to download connect IPS linking pdf form & take a printout of that document. Then submit the document to that branch where your account exists. Banks will start enrolment process after successful liking to your account bank will inform you through email & sms. Now you can initiate a money transfer to any banks.

If need instant transfer you have to initiate your transfer before 12:30 pm (Sunday – Friday). If you initiate transfer after 12:30 pm the transfer will delay or may available on next working days. On every Saturday & Nation holidays, connectIPS won’t transfer the amount on the same day. Your transfer may be in a queue for the next working day.

How to create a new account to connectIPS?

Here we are going to explain all the steps & procedure about connectIPS account. Creating an account on connectIPS is simple just download the apps from here & follow the steps.

1. Open the app you get this interface tap on Register Now

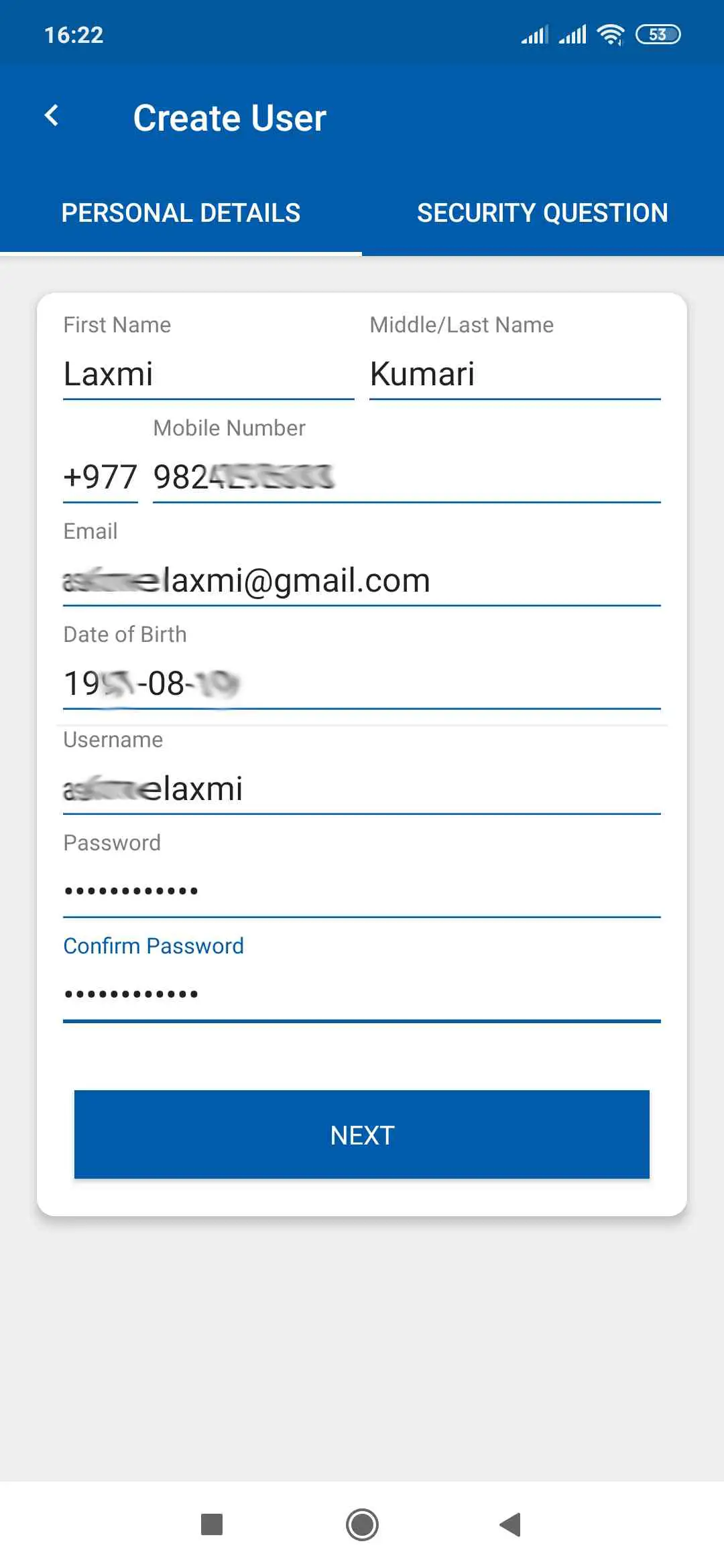

2. Fill your personal details carefully

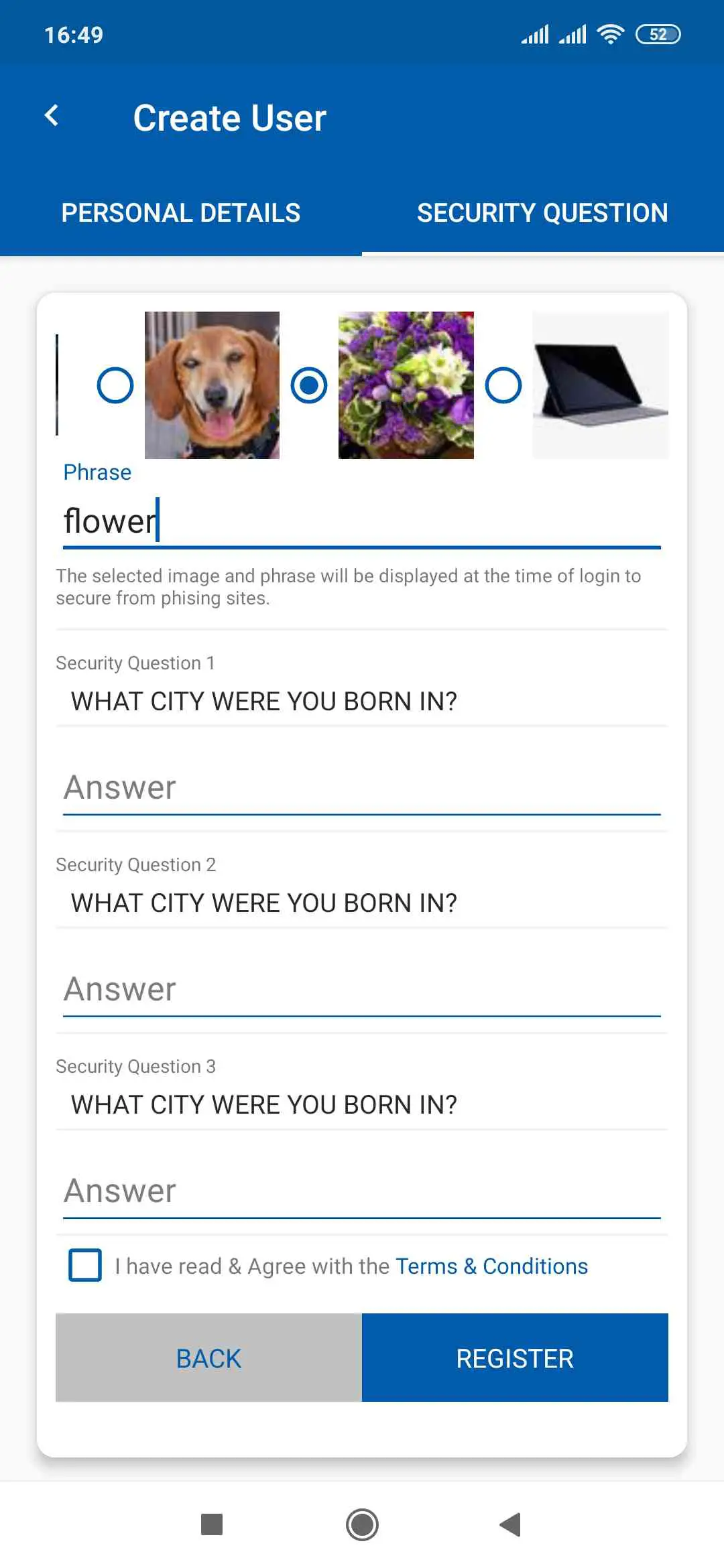

3. Choose the security phrase:

a. Choose any image which you like & fill the name of image

b. Choose the security questions & answer it

c. Check the terms & condition box

d. Tap to register

4. You have successfully registered kindly login with your ID & Password.

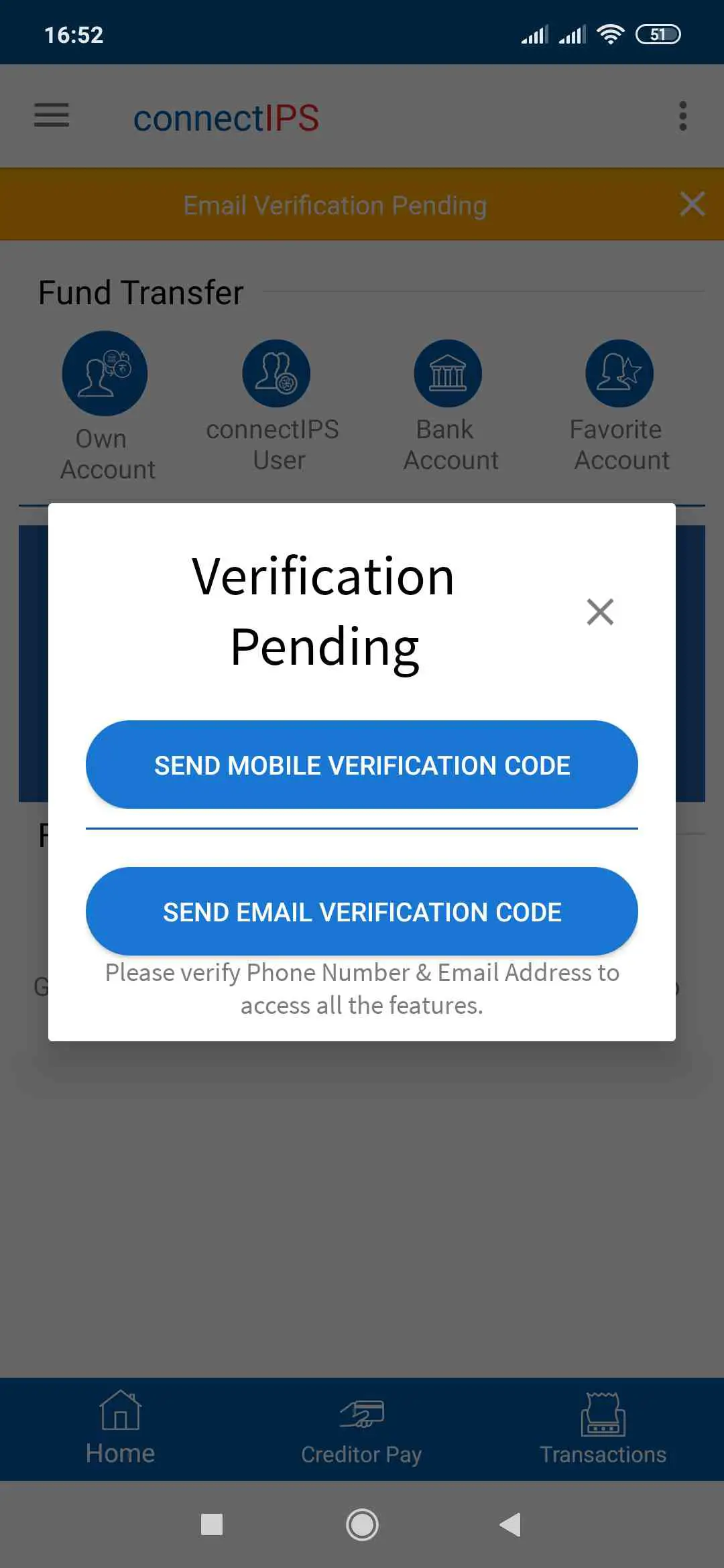

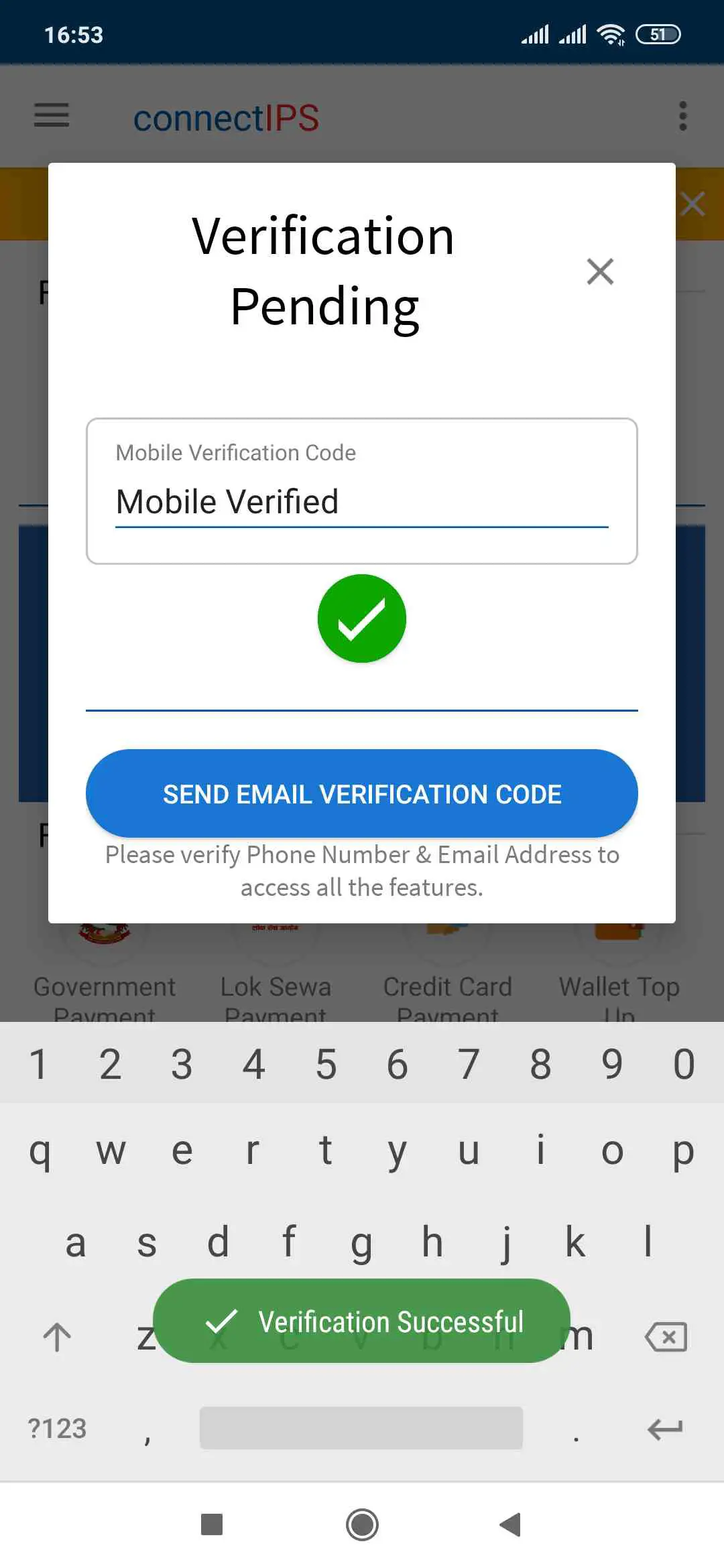

5. Now you will verify by OTP sending on your mobile & email address.

6. Congrats now your mobile & email has been verified.

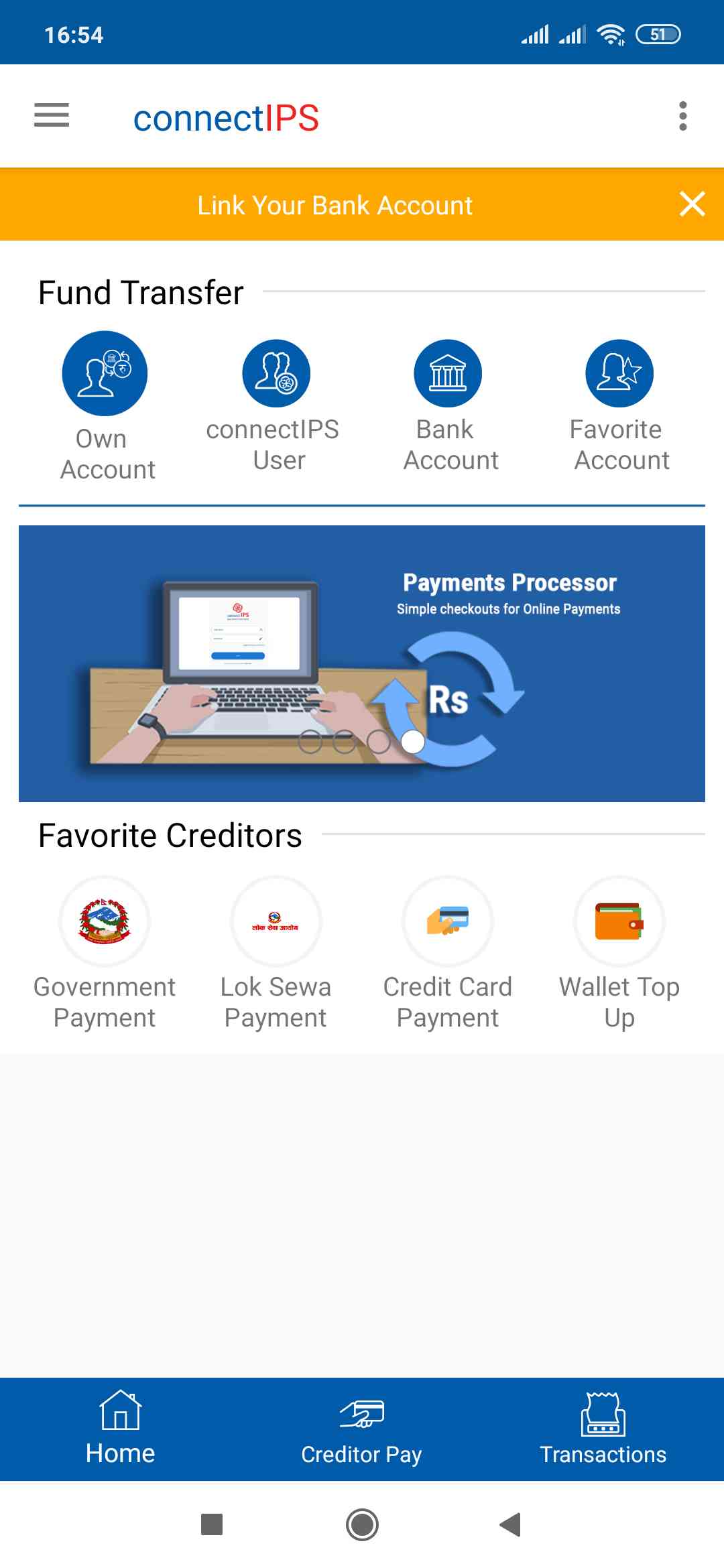

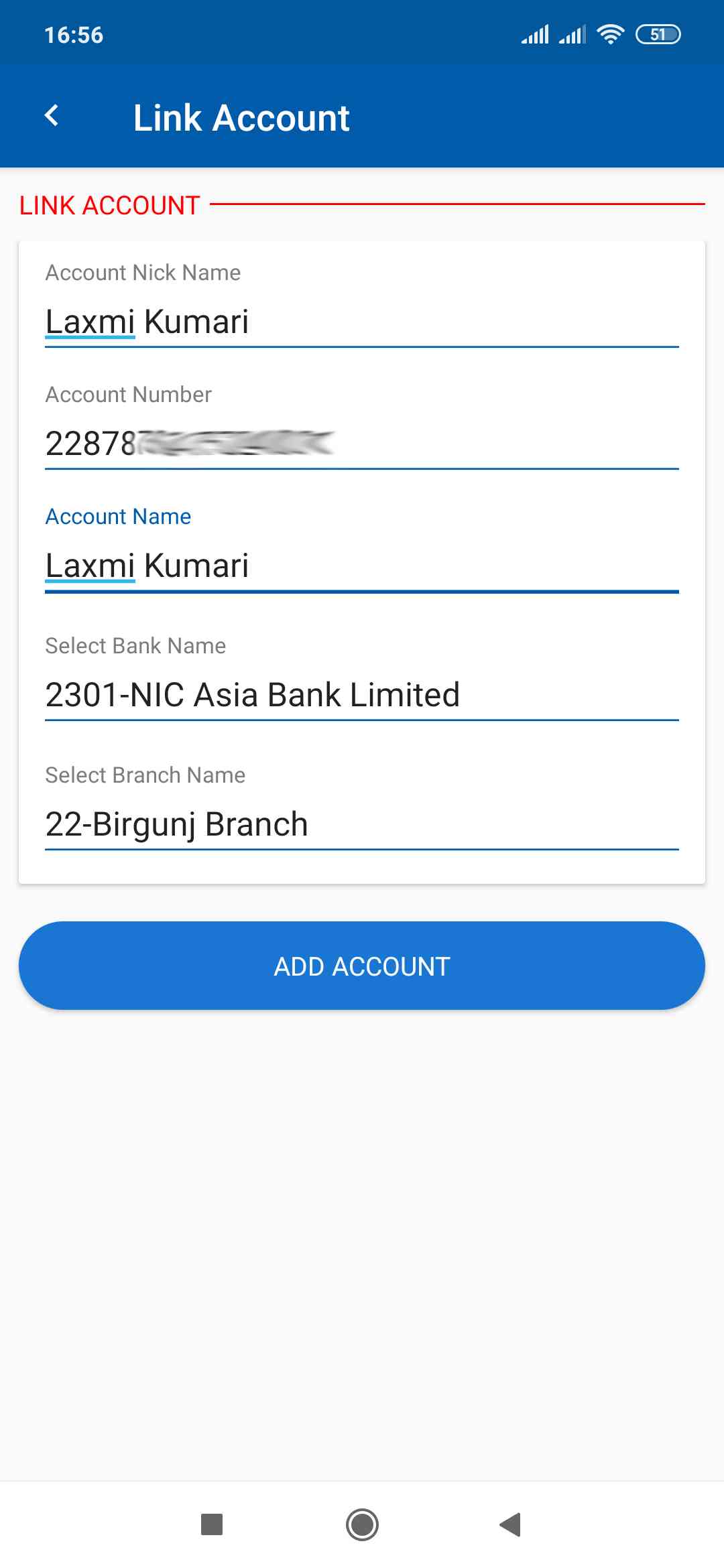

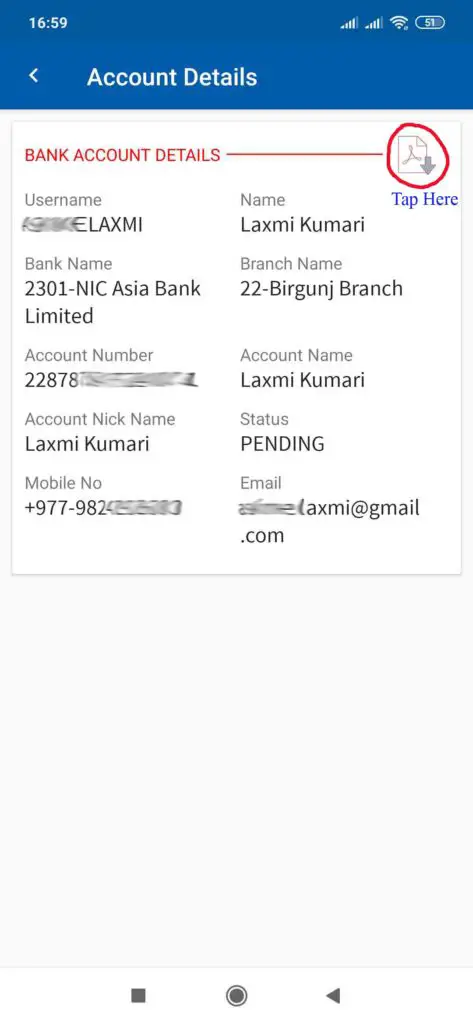

7. Now link your bank account by taping on the link option. if this option doesn’t appears on your app kindly skip these step & proceed to step 8.

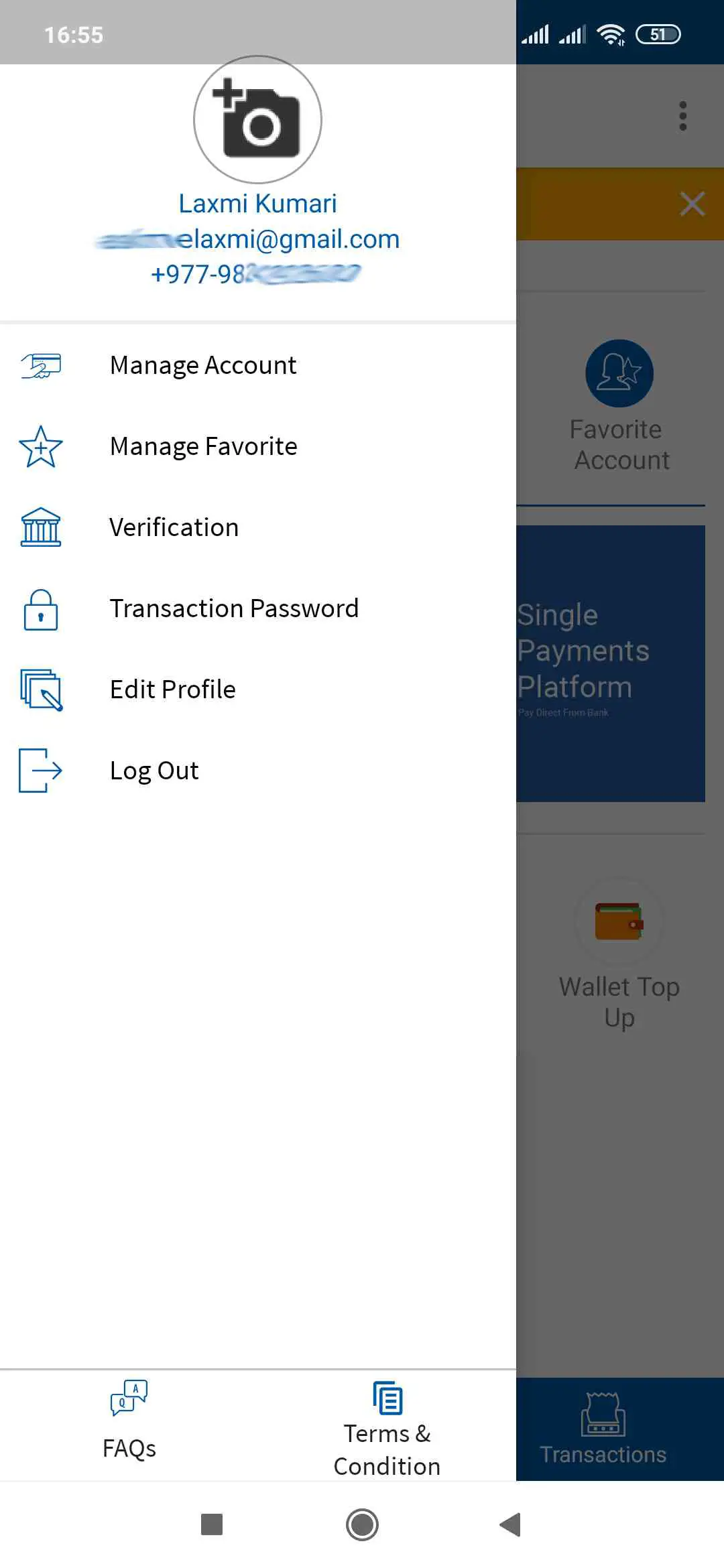

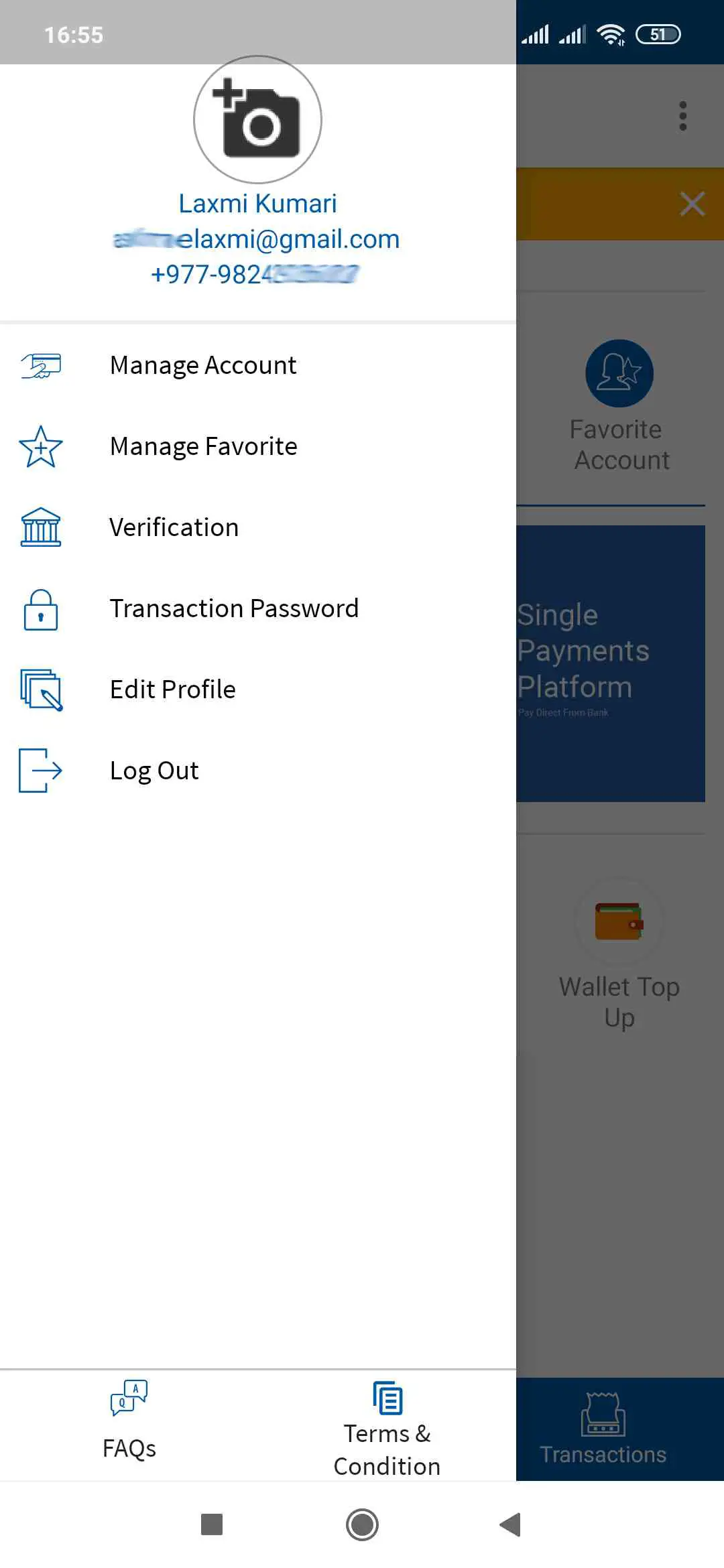

8. Tap to the upper left side of the Conner(where three parallel lines appear). Then tap to option “Manage Account”

9. Now you will seen a plus sign at down to right corner tap on it.

10. Choose the bank & branch where your account exists

Put your Name, Account number & Nick name. Your full name is usually set as your Nick name by the bank. But if you have activated your internet banking then your internet banking login ID will be your Nick name.

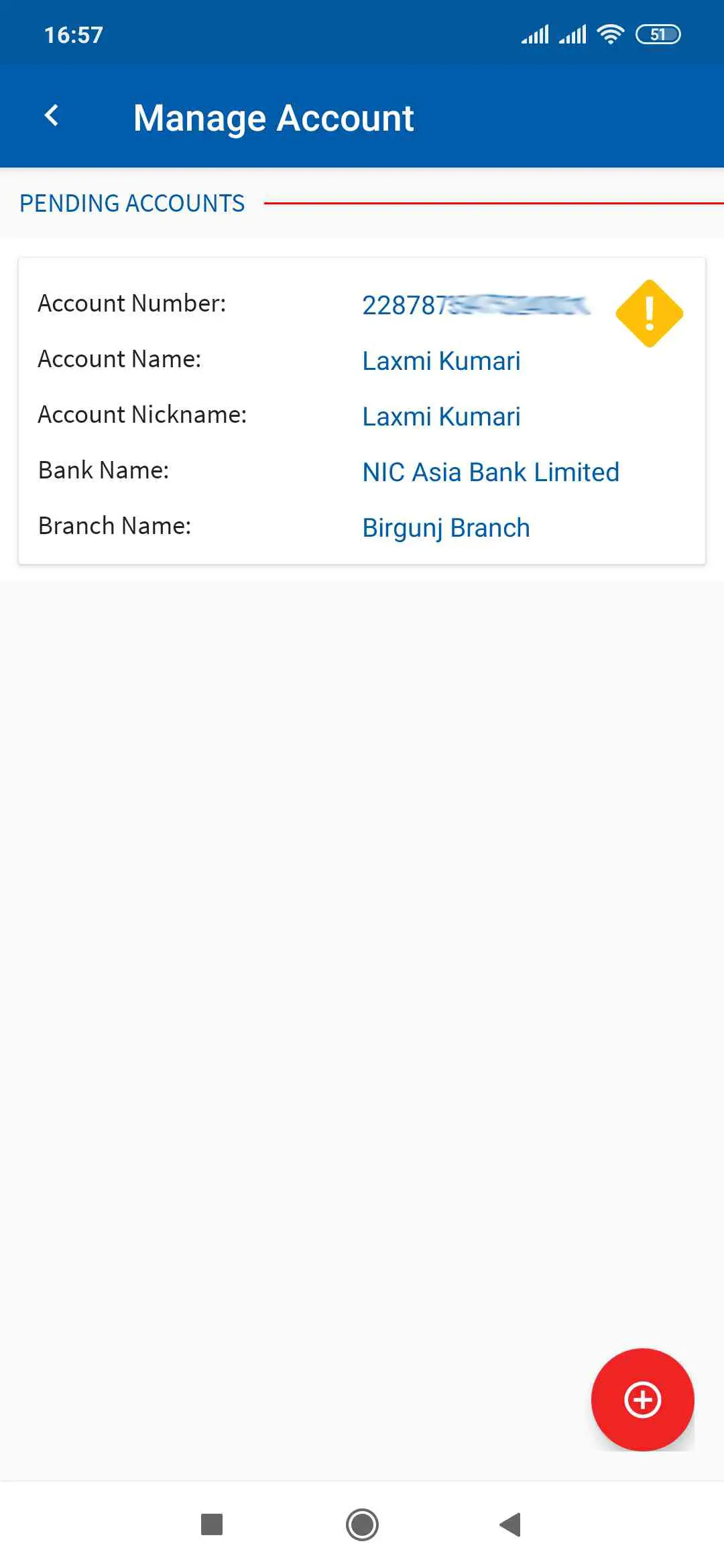

11. Now you have successfully added you bank account to connectIPS

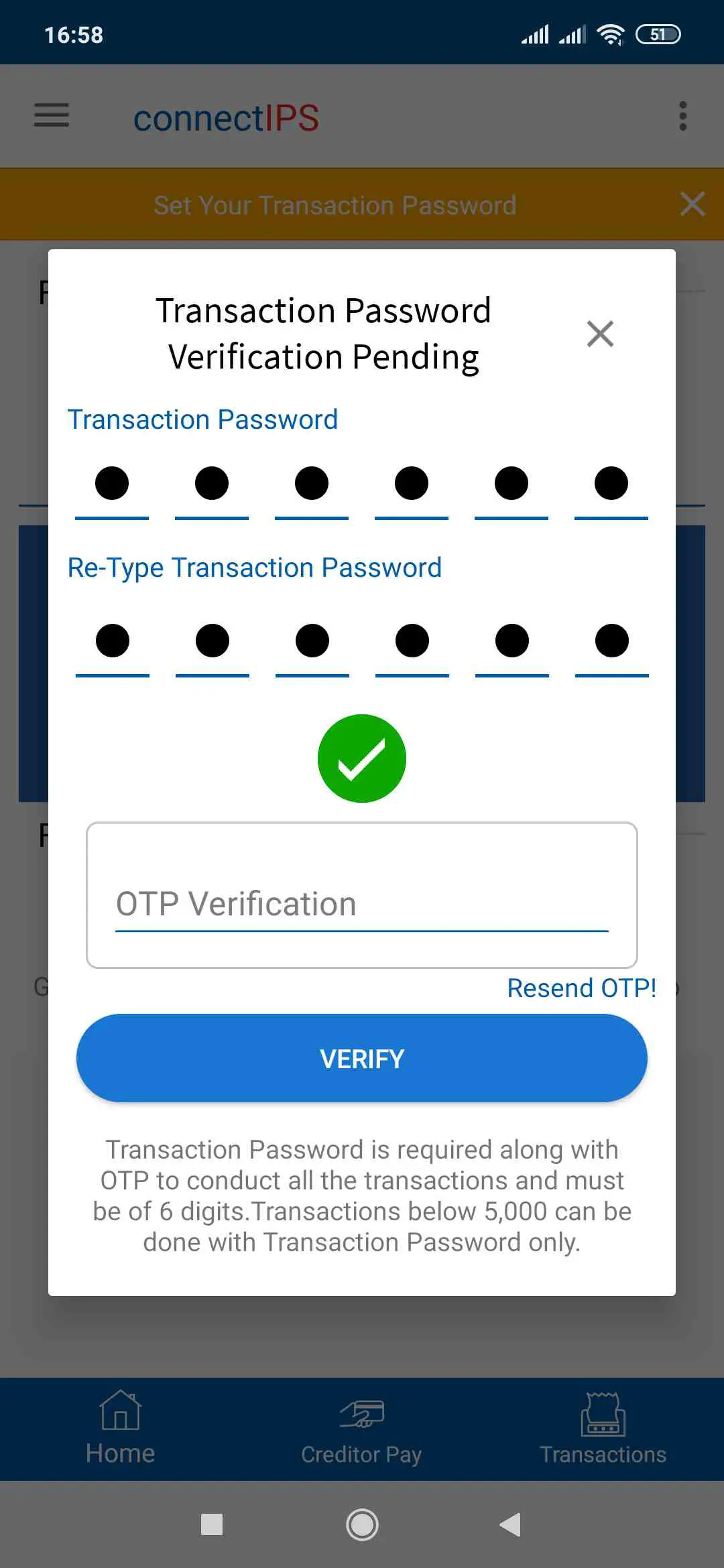

12. Now set the transaction password & verified by OTP

13. Again tap to the upper left side of the Conner(where three parallel lines appear). Then tap to option “Manage Account”

14. Now tap on PDF sign download the form & take a printout of four page documents.

15. Kindly visit the bank with this printout & copy of citizenship or passport.

Visit the same branch where your account exists to avoid the delay of the enrollment process to your bank account.

Now you can get 100 rupees for successful enrollment to connectIPS. NHCL will despite 100 rupees to the same bank account so hurry up, this offer is for limited period.

How to use free mobile & internet banking of any bank?

If you want to use the mobile & internet banking service free of cost then this post is for you. Generally, banks of Nepal are charging Rs. 150 to 500 per year for mobile & internet banking. Now a day many banks are activating your mobile banking without your request if you contact the bank & ask why my mobile baking is activated without my permission? Then they will reply it’s a promotional offer we will not charge any fee for this is service it’s absolutely free. But the reality is, they will charge you annually from next year.

If you have an account on different banks & each account has been activated with mobile & internet banking then your spending lots of money per year. It’s a big headache to memorize each account ID and password. Even it became much fur-stating after every three months when you have to change the login & transaction password.

Here we have the solution you don’t have to spend a penny on mobile banking or internet banking & you can transfer money at the lowest fee with free of cost. You have to enroll in connectIPS & add all your bank accounts. After successfully enrollment to connectIPS you can check your account balance & mini statement of any account connected to connectIPS.